Expert Insights on Navigating Offshore Business Formation Successfully

The details included in browsing the complexities of offshore business development can be daunting for even skilled entrepreneurs. As we dig right into the subtleties of selecting the ideal territory, understanding legal demands, taking care of tax ramifications, developing financial partnerships, and ensuring compliance, a riches of understanding waits for those looking for to master the art of offshore business formation.

Choosing the Right Jurisdiction

When taking into consideration offshore business development, selecting the ideal jurisdiction is an essential decision that can substantially influence the success and operations of business. Each jurisdiction supplies its own collection of legal frameworks, tax obligation guidelines, privacy legislations, and monetary incentives that can either benefit or impede a company's goals. It is essential to perform complete research and look for specialist advice to make sure the selected territory lines up with the business's goals and demands.

Factors to take into consideration when choosing a jurisdiction include the economic and political stability of the region, the ease of operating, the degree of financial privacy and discretion used, the tax obligation ramifications, and the regulatory environment. Some jurisdictions are recognized for their beneficial tax obligation structures, while others focus on personal privacy and property security. Recognizing the unique features of each jurisdiction is important in making an educated choice that will certainly support the long-lasting success of the offshore company.

Ultimately, picking the appropriate territory is a calculated step that can supply chances for growth, asset protection, and functional effectiveness for the offshore firm.

Recognizing Legal Requirements

To ensure conformity and authenticity in offshore company development, a thorough understanding of the lawful demands is necessary. Different jurisdictions have differing legal structures controling the establishment and procedure of offshore companies. It is crucial to perform complete research or look for professional suggestions to comprehend the particular lawful terms in the chosen territory. Usual legal needs may consist of registering the firm with the proper governmental bodies, adhering to anti-money laundering guidelines, maintaining precise economic records, and meeting tax commitments. Additionally, recognizing the reporting demands and any kind of required disclosures to regulative authorities is vital for ongoing conformity. Failure to abide with legal demands can cause severe repercussions, such as penalties, penalties, or also the dissolution of the overseas company. Remaining informed and up to date with the legal landscape is crucial for successfully navigating offshore business development and making certain the long-term sustainability of the business entity.

Browsing Tax Obligation Effects

Recognizing the detailed tax obligation ramifications related to offshore company development is crucial for ensuring conformity and enhancing monetary techniques. Offshore companies frequently provide tax obligation benefits, but browsing the tax obligation landscape requires thorough expertise and appropriate planning. One key factor to consider is the idea of tax residency, as it establishes the territory in which the company is strained. It's important to comprehend the tax obligation legislations of both the offshore territory and the home country to avoid dual taxation or unplanned tax effects.

Furthermore, transfer rates policies have to be very carefully evaluated to make sure purchases between the overseas entity and relevant parties are carried out at arm's size to avoid tax evasion complaints. Some jurisdictions use tax obligation motivations for specific markets or tasks, so understanding these rewards can assist make the most of tax financial savings.

Moreover, staying up to date with progressing global tax obligation regulations and compliance demands is crucial to stay clear of fines and keep the business's reputation. Looking for professional guidance from tax obligation specialists or professionals with a fantastic read experience in offshore tax obligation matters can provide important insights and guarantee a smooth tax planning process for the offshore company.

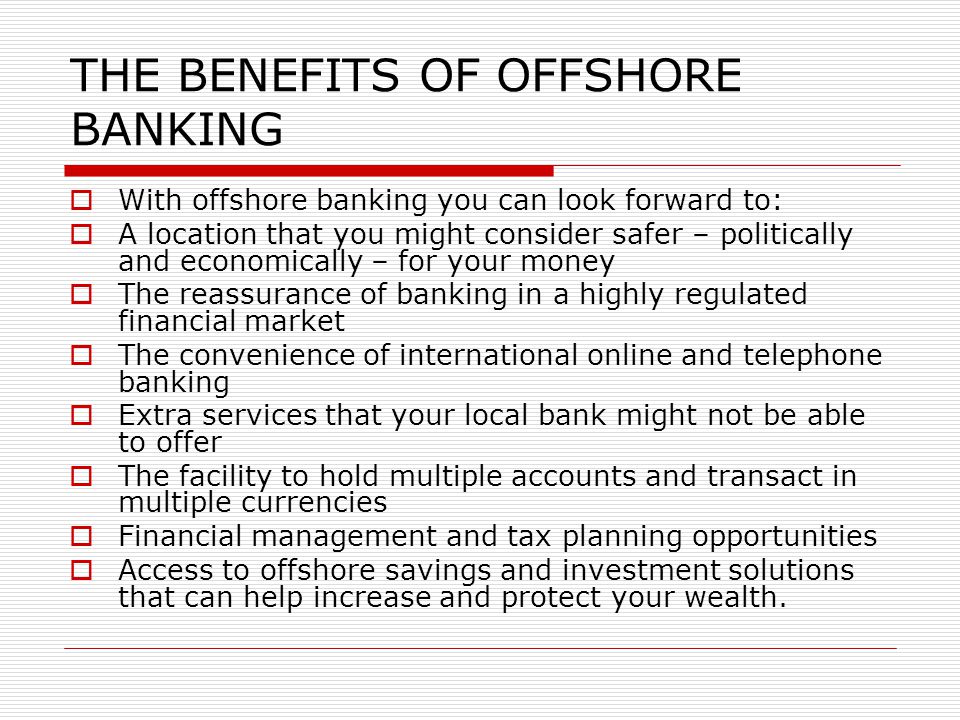

Establishing Banking Relationships

Establishing secure and reputable financial partnerships is a critical action in the procedure of offshore company formation. offshore company formation. When establishing up financial connections for an offshore company, it is important to choose trusted financial institutions that offer services customized to the details requirements of worldwide businesses. Offshore companies usually call for multi-currency accounts, electronic banking centers, and smooth international purchases. Choosing a bank with an international existence and knowledge in taking care of offshore accounts can make imp source sure and simplify monetary operations compliance with worldwide policies.

Furthermore, prior to opening a savings account for an overseas business, detailed due diligence treatments are typically required to validate the legitimacy of the business and its stakeholders. This may entail supplying thorough documents concerning the firm's tasks, resource of funds, and advantageous proprietors. Building a cooperative and transparent connection with the picked financial institution is key to navigating the complexities of overseas banking successfully.

Guaranteeing Conformity and Reporting

After establishing protected financial partnerships for an overseas business, the following crucial action is making sure compliance and reporting procedures are carefully adhered to. Engaging lawful and financial professionals with expertise in overseas territories can help browse the complexities of conformity and reporting.

Failure to comply with guidelines can lead to severe charges, penalties, and even the cancellation of the offshore business's license. Staying aggressive and alert in making sure compliance and coverage requirements is critical here are the findings for the long-lasting success of an overseas entity.

Final Thought

In verdict, effectively browsing offshore firm formation needs careful factor to consider of the jurisdiction, lawful requirements, tax effects, banking partnerships, compliance, and reporting. By recognizing these essential variables and guaranteeing adherence to laws, companies can develop a solid foundation for their offshore procedures. It is crucial to seek specialist guidance and know-how to browse the complexities of offshore business development effectively.

As we delve into the nuances of selecting the best jurisdiction, recognizing lawful needs, managing tax obligation ramifications, developing banking connections, and making sure conformity, a riches of understanding awaits those seeking to grasp the art of offshore company formation.

When considering overseas firm development, choosing the proper jurisdiction is a vital decision that can considerably impact the success and operations of the business.Recognizing the detailed tax obligation implications associated with overseas business formation is crucial for ensuring conformity and enhancing monetary strategies. Offshore firms usually give tax obligation advantages, but browsing the tax landscape requires thorough expertise and appropriate planning.In verdict, effectively browsing offshore company development requires mindful consideration of the jurisdiction, lawful requirements, tax obligation ramifications, banking partnerships, conformity, and coverage.